HOW IT WORKS

CTA: Corporate Transparency Act

- The CTA requires most startups to file an informational report (BOI filing) with the Financial Crimes Enforcement Network (FinCEN)

- The act is intended to prevent money laundering, terrorist financing, and other financial crimes

- Initial BOI filings require information on the entity and personal information of the “beneficial owners” (officers, major shareholders and decision makers)

- Follow-on BOI filings are also required, within 30 days, for any change to the previously reported data

- Fines of up to $10,000 will be levied for late or misleading filings

HOW WE CAN HELP

Accountalent can handle your filings

- Rely on your trusted tax and accounting experts for BOI filings

- Reporting aligned with the latest CTA developments

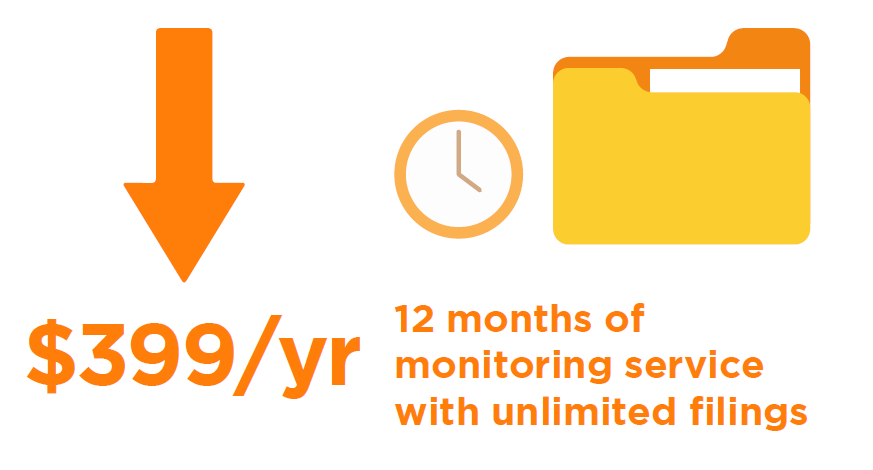

- Monitoring services to ensure changes are reported within 30 days

- Previous BOI filings maintained to allow for easy update reporting

Key Dates

- January 1, 2024 – Act goes into place

- December 31, 2024 – initial filing due for entities established before 2024

- 90 days after entity creation – initial filing due for entities established on or after January 1st, 2024

- 30 days after change – follow-on filings due for entities with changes, post previous filing

Get Started Today!

Got questions? We’re here to help. Discuss your needs with us.

[email protected]

(603) 540-0351