Recovery Startup Business: RIP OFF ALERT – How to take advantage of this credit

Are you a Recovery Startup Business? You might be and not even know it.

The Employee Retention Credit (ERC) continues to evolve, getting richer and crazier by the day. That means more money for your company IF you fall under the definition of a Recovery Startup Business and don’t get scammed along the way.

So how does the ERC for these newly-formed startups work?

You receive a check from the IRS – up to $50K per quarter – for Q3 2021 and Q4 2021. That’s it! $100K just for asking.

The formula is rather the same as the ERC: 70% of the first $10K in wages. So, if you have 7 employees getting paid a bit over minimum wage, you will get $100K from the government.

HOWEVER, STARTUPS BEWARE!

Gusto and Rippling recently announced that you will need to get an outside firm to amend your payroll tax returns in order to take this credit and receive your money as a Recovery Startup Business.

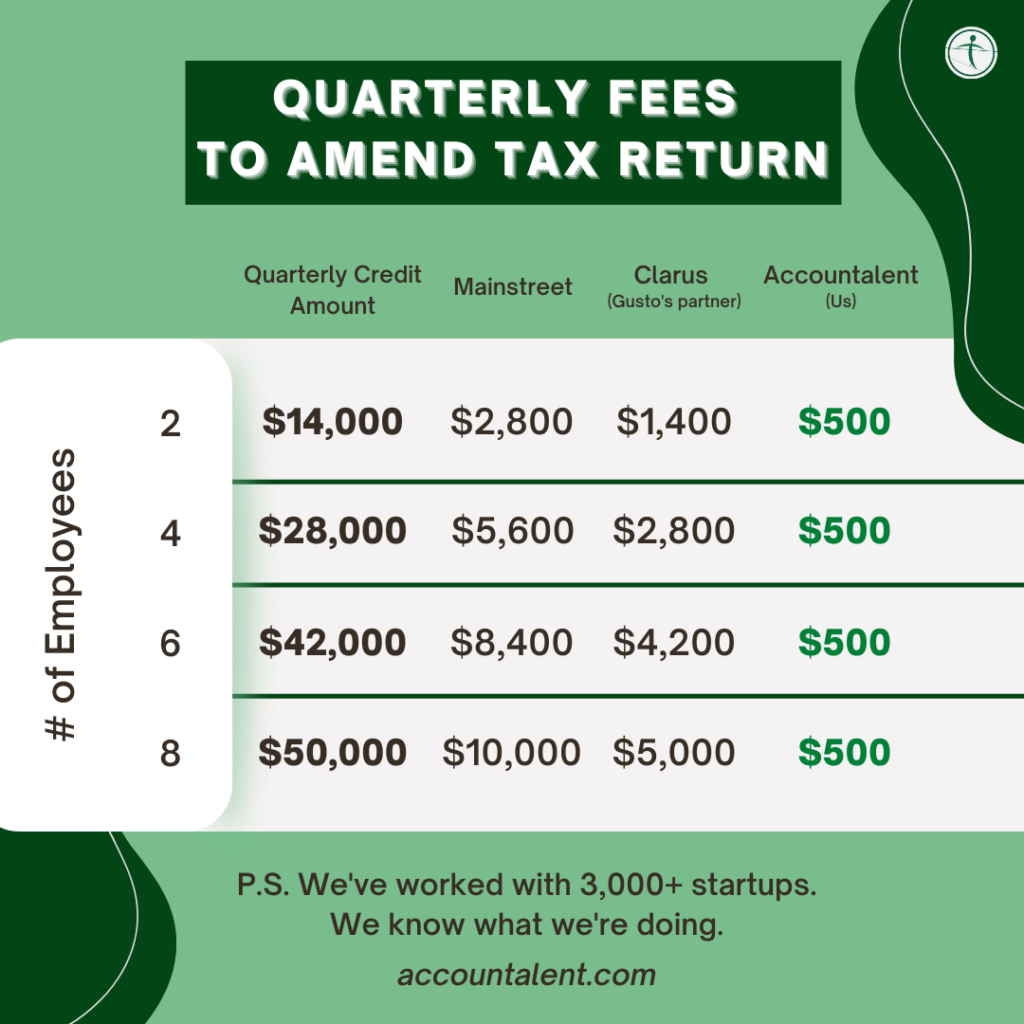

As a result, popular firms are taking advantage this and charging you 20% of your credit to amend your payroll tax returns to take advantage of this credit. Do NOT get ripped off!

“I am seeing posts from Bay Area firms – the usual suspects – advertising their services to help startups get the ERC and the new $50K ERC for Recovery Startup Business,” Accountalent founder Joe Faris said in a recent LinkedIn post.

“They will charge you 10-20% of this credit.” There is no reason to pay so much! The usual suspects will charge you up to $5,000 – $10,000 PER QUARTER to claim this credit. This is a ridiculous fee.

Accountalent can help you claim this credit for only $500 per quarter. Keep more money in your startup and extend your runway with Accountalent.

Even if you are not a current client of Accountalent, contact us and we will help you!