The LinkedIn Equity Story – Two Home Runs for Shareholders

The founders of LinkedIn were masters at managing equity. So, well, in fact, the shareholders enjoyed not one, but two major home-run liquidity events.

The Private Company Years – 2002 to 2011:

- LinkedIn was founded by Reid Hoffman in 2002 and launched just five months later

- Early funding included an Angel round followed by Series A, raising over $5M

- Marc Andreessen participated in the Angel round and Greylock in the Series A

- LinkedIn reached profitability in 2006

- Between 2008 and 2010, LinkedIn raised most of its remaining funding, reaching a total of $150 million.

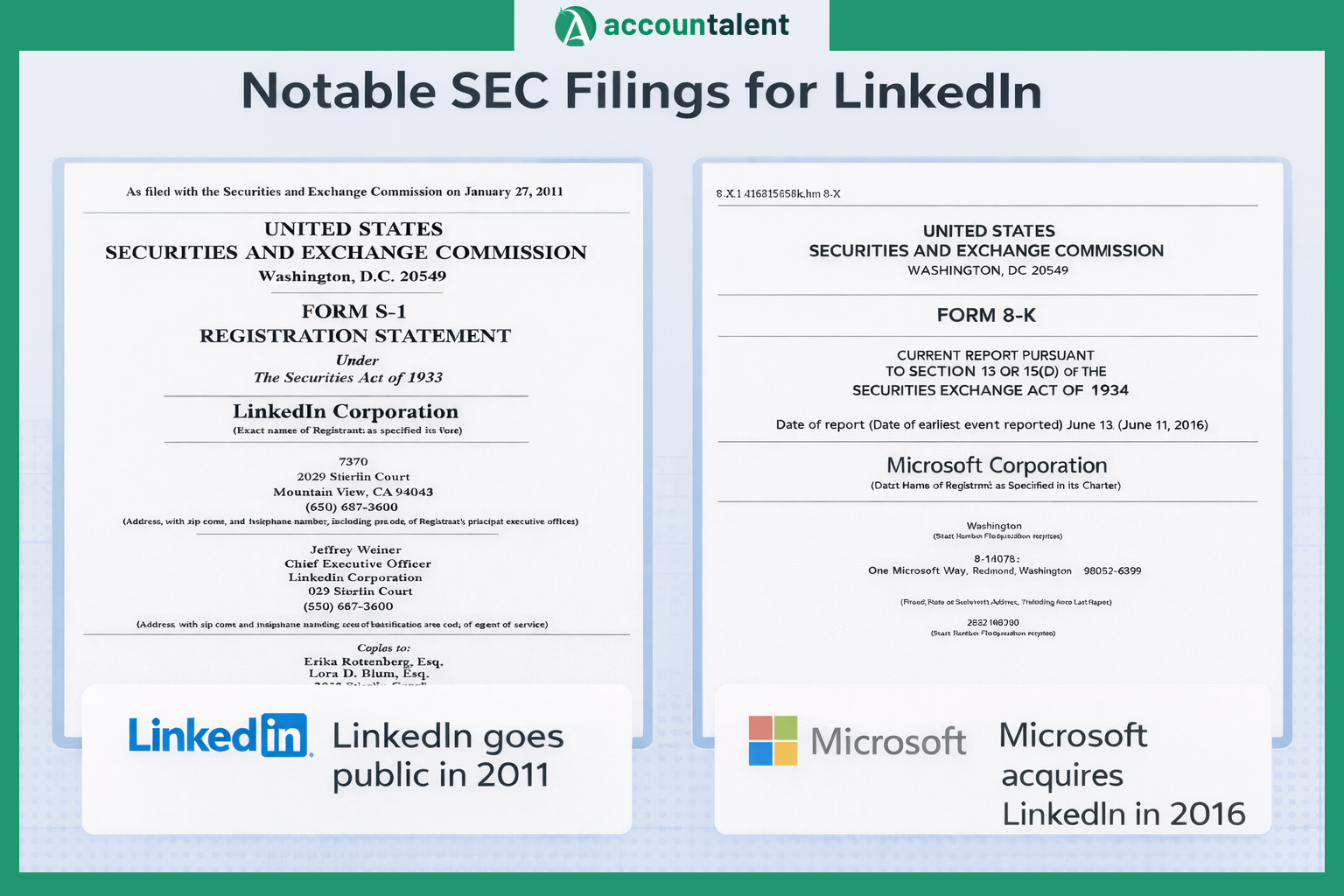

IPO – 2011 (Home Run #1):

- Pre-IPO valuation: $2B

- Valuation at IPO pricing: $4.25B

- Valuation at the end of the first trading day: $9B

- Value of Reid Hoffman’s shares after day one: $2B

- Pre-IPO shareholders controlled 99% of the voting power due to a dual class stock structure:

- Insiders had Class B shares: 10 votes per share

- Public had Class A shares: 1 vote per share

- Highest market valuation as a public company: $30B

Microsoft Acquisition – 2016 (Home Run #2):

- Purchase Price: $26.2B in cash (remember, they went public at a $4B valuation)

- LinkedIn stock price just prior to the announcement: $131per share

- Microsoft acquisition offer price: $196 per share – a 50% premium

- Between IPO and the acquisition, Reid Hoffman sold about 4.5M shares

- Even after those sales, he still held 14.5M shares worth about $3B

Observations From the LinkedIn Story:

- Equity was treated as a precious resource

- Early valuations were reasonable and that limited founder dilution

- Profitability came early, reducing dependence on outside capital

- Founder ownership stayed meaningful all the way to the Microsoft acquisition

- Stock sales by founders were gradual and measured

- The dual-class stock structure balanced public investment with long-term control

- Big decisions appeared to favor long-term value over short-term optics

Bottom line:

The process looked steady, patient and disciplined – the opposite of the “raise as much as possible as soon as possible” mentality.

LinkedIn is a great example of how a thoughtful capital strategy and respect for equity can create extraordinary long-term outcomes.